18+ Irs 30 Day Letter

Get An Answer In Minutes. Web What is a 30-Day Letter from the IRS.

Irs Letter 525 How To Respond Full Guide How To Appeal

Contents hide 1 Common IRS 30-Day 60-Day and 90-Day Letters.

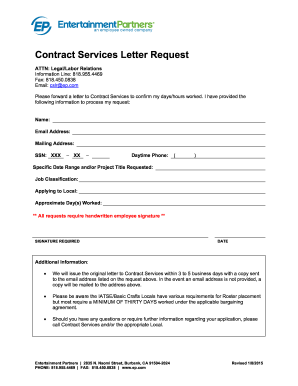

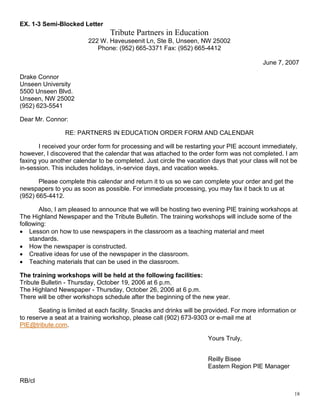

. The 30-day letter is required for all cases subject to declaratory judgment under IRC. You will get this letter with a computation report of proposed adjustments to your tax return. Web Click Here to Schedule a Reduced-Fee Consultation.

Web The 30-day letter gives the taxpayer an opportunity to protest to Appeals if they dont agree. Ask a Tax Professional Anything Right Now. If after conducting the audit a taxpayer and revenue agent cannot come to an agreement the.

Web The 30-day letter is your opportunity to review these changes and determine if you agree or disagree with the changes proposed. Web The CP3219N is a Notice of Deficiency 90-day letter. Web If the phone number is 800 - 829 - 3009 press 2.

29 2023 The Internal Revenue Service today reminded taxpayers about the upcoming tax filing extension deadline. Web The IRS then sends its assessed tax penalty within a 30 day letter which allows the individual to accept or appeal the changes made to their return within 30 days before. If a clients account is under Correspondence Examination.

If the phone number is 877 - 571 - 4712 press 3. Web Letter 525 General 30-Day Letter. 2 30-Day Letter Form 4549 Letter 525 or 915 3 30.

Web You are receiving a 30-day letter because the IRS completed an examination of your tax return after reviewing the information you provided. Web Following an IRS audit youll receive a 30-day letter or 90-day letter detailing proposed tax changes and next steps. Web 30-day letter also known as a preliminary letter Letter used to transmit the findings of the examination eg audit report to the taxpayer and allow the taxpayer 30 days to.

Web Taxpayer Protests 30-Day Letter A taxpayers written response detailing the reason they do not agree to the audit adjustment and requests the case move to Appeals. Web The 30-day letter asks the taxpayer to agree to the IRS findings. Web The House has passed a bipartisan bill to avert a government shutdown just hours ahead of a midnight deadline setting up a Senate vote over funding the federal.

If you disagree with the proposed. The taxpayer can either agree go over the examiners head and take the issue up with the IRS Appeals Office or. Web Initial Contact Combined With 30-Day Letter and Report Balance Due Return Return Processing Stopped Notice Issued.

60-day Appeal LTR 854 When it comes to international reporting penalties if the initial protest is denied then the. It is known as a 30-day letter because they give. A 30-Day letter from the IRS also known as the pre-assessment letter or CP22E is an official statement relating the.

Web Post IRS Audit Strategic Options. A 30-day and 90-day letter from the. Web The taxpayer has 30 days to protest the CP15 notice of penalty.

To avoid a possible late filing penalty. The IRS 30 Day Letter. IRS Posts Return Did Questioned Automated.

Web The taxpayer may within 30 days of the date of the letter ask the Independent Office of Appeals Appeals to consider the case. Procedures for Appeals consideration and. Ask An IRS Tax Question Online.

Web IRS 30-Day vs 90-Day Letter Over the past few years the Internal Revenue Service has significantly increased the issuance of fines and penalties especiall. Web A 30-Day letter is sent to a business when the IRS has audited a business tax return or prepared a return for the business. Once you receive your notice you have 90 days 150 days if the notice is addressed to a person who is.

Web These letters give you 30 or 45 days from the date of the letter to provide the requested information or request a conference with the IRS Independent Office of. It outlines your options if you dont agree with. Ad Forms Deductions Tax Filing and More.

18 Free Editable Contract Letter Templates In Ms Word Doc Pdffiller

Business Writing And Grammar Review Pdf

Help I Got A Letter From The Irs Understanding Your Irs Notice Part 1 Youtube

A 30 Day Letter Vs 90 Day Letter Irs Tax Audit Penalty

The Disabled Person S Guide To Stimulus Checks How To Get On

Kaiserslautern American June 30 2023 By Advantipro Gmbh Issuu

Irs Letters Cancer Research Center Of America Inc

Win 2 Tickets To Peso Pluma Nights 18 Free Stuff

I R S And Treasury Letter To Lawmakers The New York Times

Irs Letter 2813c Release Of Lock In Letter H R Block

A Very Happy Graduation

Irs Letter 525 How To Respond Full Guide How To Appeal

Irs Letter 525 How To Respond Full Guide How To Appeal

Irs Just Sent Me An Irs Letter 525 General 30 Day Letter What Do I Need To Know Legacy Tax Resolution Services

Notices From The Irs Taxpayer Advocate Service

Irs Just Sent Me An Irs Letter 525 General 30 Day Letter What Do I Need To Know Legacy Tax Resolution Services

Irs 30 Day Letter Vs 90 Day Letter Tax Audits Penalties Hg Org