Annual income tax calculator

600000 then the rate of the income tax is 0. With a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403.

Self Employed Tax Calculator Business Tax Self Employment Self

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

. The annual income calculators main aim is to help you find your yearly salary. 2880 monthly wage 12. Multiply the result by 100 and thats it.

The Income tax calculator uses your annual salary by default if you prefer to calculate your annual incometax using a differant payment paried please change the income period in the advanced settings. Hourly rate to annual income. If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR.

Tax-Advantaged Dividend Income Fund EVT PRODUCT FINDER. Your household income location filing status and number of personal exemptions. Simple online tax calculator.

You already made tax payments for the year but your annual income ended up less than planned. Divide your net incomeincome after taxnet annual income by your gross incomeincome before taxgross annual income. It is mainly intended for residents of the US.

It can be used for the 201516 to 202122 income years. And is based on the tax brackets of 2021 and 2022. Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

This calculator will help you work out your tax refund or debt estimate. Deduct the same from the NAV to comprehend the loss or income from your housing property. How Income Taxes Are Calculated.

To obtain the most recent annual and semi-annual shareholder report for a closed-end fund contact your financial advisor or download a copy here. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Selecting a specific tax calculator that reflects the period for which you are paid or select annual to use your total annual income to produce a tax calculation of your annual Federal and State Tax return in 2022 you can also.

You can compute the Net Annual Value NAV by deducting the already paid municipal taxes during the GAV year. Please note that the change will only apply to Employment Income and Employment expenses all other tax credits and tax deductions are. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Hourly employment and a brief history of wages and salaries. However it can calculate the rest of the variables - it depends on which values you input first. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as.

In 2022 the claim limit for single head-of. How to calculate Federal Tax based on your Annual Income. Required Income Calculator for a Mortgage Calculator.

Updated with the platest UK personal income tax rates and thresholds for 2022. Call Us 65 6320 1888. Use our free income tax calculator to work out how much tax you should be paying in Australia.

Enter your annual salary. Before purchasing any variable product. If the annual salary income does not exceed PKR.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments. 30 of NAV - Interest.

Know Tax Slab for Individuals below 60 years of age Senior citizens and super senior citizens. The highest personal income tax rate of 22 are for individuals with an annual taxable income of more. However an individual is required to pay a late filing fee if heshe is filing belated ITR.

01 Jul 2022 QC 16693. 325c for every dollar between - 0. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

This deduction also cannot be claimed if Modified Adjusted Gross Income exceeds the annual limits. DTI is the percentage of your total debt payments as a share of your pre-tax income. Salary income exceeds PKR 12 Million but is under PKR 24 Million.

This determines your applicable tax slab rates. The above calculator provides for interest calculation as per Income-tax Act. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Check the New Income Tax Slabs and Rates for 2022-23. 19c for every dollar between 18201 - 0.

The Annual tax calculator is a comprehensive calculator for salary income tax dividends overtime pay rise and payroll calculations online. Your household income location filing status and number of personal exemptions. This estimate is for an individual without other expenses and your situation may differ.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Income Tax Calculator - Learn How to Calculate Income Tax Online for FY 2022-23 AY 2023-24 with ICICI Prulifes Income Tax Calculator. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

No tax on income between 1 - 18200. Check this flexible annual salary calculator to recalculate all your payments. The Canada Annual Tax Calculator is updated for the 202223 tax year.

Your household income location filing status and number of personal exemptions. Calculate your Federal Tax return in seconds. This income tax calculator Pakistan helps you to calculate salary monthlyyearly payable income tax according to tax slabs 2022-2023z.

Review your income tax liabilities. Once you enter these details subsequent fields. Estimate your personal tax payable for the current assessment year using our free online Singapore Personal Income Tax Calculator.

The last date of filing belated ITR is December. Singapore Company Registration Specialists. In the article below you can find information about salary ranges comparison of salary vs.

How Income Taxes Are Calculated. 720 weekly wage 52 weeks 37440 annually. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

You have done things that qualify for a tax relief made private pension contributions given to charity etc In your case when you earn 50000. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. You can include the total salary inclusive of all bonuses and variable components.

This means for an annual income of you pay. The Income Tax Calculator offered by BankBazaar can be used to calculate the income tax on salary that must be paid. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. You pay 7286 at basic.

You pay no income tax on first 12570 that you make. Salary Income Tax Calculator 202223.

Calculate Income Tax Factory Sale 53 Off Empow Her Com

How To Calculate Taxable Income On Salary

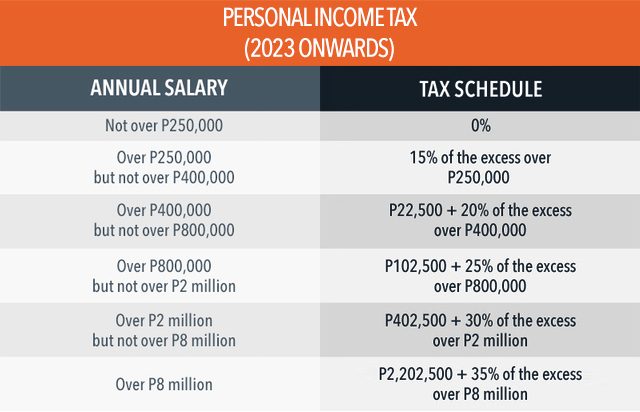

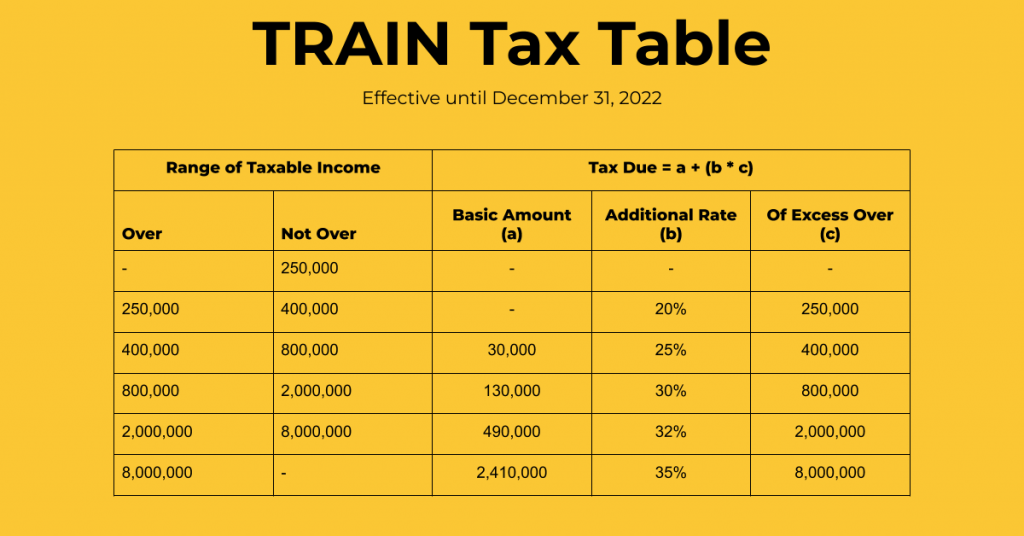

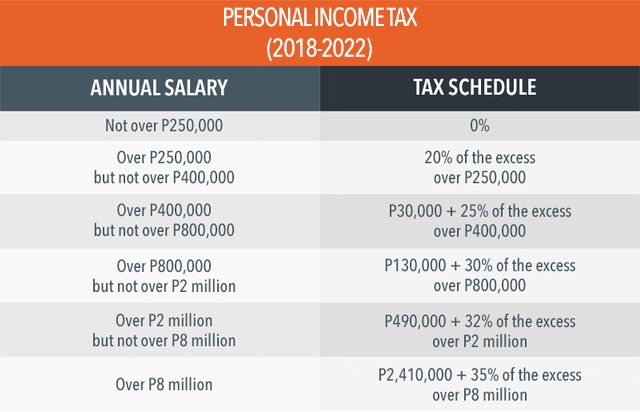

Tax Calculator Compute Your New Income Tax

Payroll Tax Calculator For Employers Gusto

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income From House Property How To Calculate Income From House Property Tax2win

Income Tax In Germany For Expat Employees Expatica

Annual Income Calculator

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

2022 Income Tax Withholding Tables Changes Examples

2022 Updated Bir Form 1701 How To File Pay Annual Income Tax

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Sars Efiling How To Submit Your Itr12 Youtube

Tax Calculators Taxtim Sa

Tax Calculator Compute Your New Income Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

30 000 After Tax 2021 Income Tax Uk